Zug based Liquineq, with its global management team, is offering a global payments platform for secure, real-time, peer-to-peer, end-to-end value exchange and payment services across borders. The startup has now secured fresh capital from the Geneva-based VC firm, blufolio to accelerate growth.

Today, blufolio AG, the Swiss blockchain investment firm and manager of the Luxembourg-registered blufolio venture capital fund focusing on Swiss and Europe based blockchain startups, announced the latest equity investment in Liquineq. The portfolio company was founded by a team of finance and technology professionals that are located all over the world (SanFrancisco, Israel, London among others). The company is incorporated in Zug.

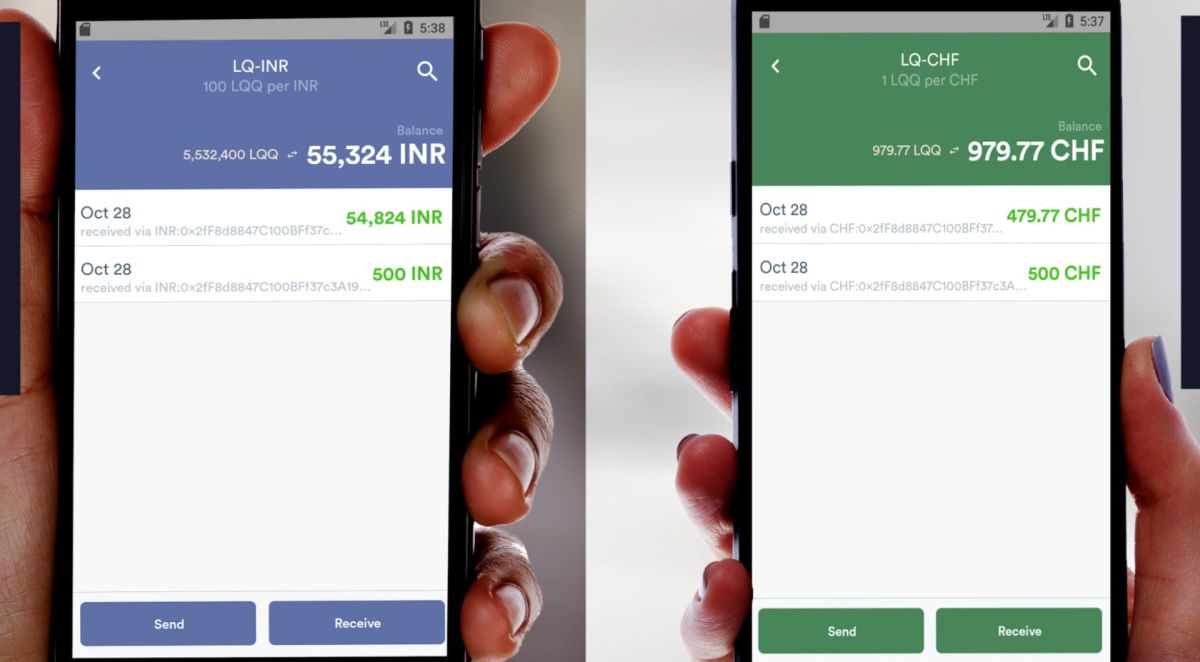

Liquineq is targeting a specific segment of the global remittances market, with strong potential for growth via a strategy of third-party partnerships. The company's flagship solution, the Liquineq Platform, enables secure, real-time, peer-to-peer, end-to-end value exchange and payment services across borders, integrating compliance and Know Your Customer (KYC)/Anti Money Laundering (AML) certification between both fiat and decentralised currencies, as well as other relevant asset classes like tokenized real estate, precious metals and other deposited items, dovetailing with existing regulation in most jurisdictions.

The technology can be used across a number of banking applications. It will initially be deployed in the growing market for global remittances, which has an annual volume of over USD550 billion and is used by one in seven people worldwide, but which is largely out of scope for the traditional banking industry due to prohibitive processing and compliance costs.

Balazs Klemm, blufolio AG founding partner says: “We are delighted to support the growth of Liquineq, which is targeting a clear gap in the market for global remittances. We see a wealth of opportunities for Liquineq’s top-drawer management team to leverage its offering via partnerships in emerging markets and look forward to accompanying them on their growth path.”

Matthew Le Merle, Managing Partner of Fifth Era and advisor at Warburg Pincus and Liquineq, comments: “For the global remittance market banks want a much faster, secure, low transaction cost, compliant and immutable distributed ledger platform that they can use on their own behalves. Liquineq has already created this solution and started the deployment. Liquineq has built a platform of the future for critical banking products and processes.”

Proof of Concepts underway

Liquineq’s roadmap includes ongoing proofs of concept in major remittance geographies such as India, the Philippines, Nigeria and Ukraine, with first live remittances performed in Q1 2019 and volume remittances scheduled to start in Q3 2019. The firm boasts an impressive patent portfolio covering its platform solution and a distinguished roster of senior advisors drawn from major financial and payments institutions including Visa, PayPal and the Federal Reserve.

(Press release/ran)

Please login or sign up to comment.

Commenting guidelines