Swiss crowdlending platforms brokered over CHF260 million in loans in 2018. Although there was a 40% increase in the total volumes, there is slow growth. Only one platform was launched last year, in contrast to three in the previous year. The good news however is; institutional investors are increasingly investing in this market.

Crowdlending platforms operate a two-sided market: they bring borrowers and lenders together over the Internet. Borrowers can be any private individuals or companies seeking funds while lenders are typically institutional investors such as foundations, investment funds and family offices. The crowdlending market is divided into three segments: consumer crowdlending, which encompasses loans to private individuals; business crowdlending which represents loans to companies, especially small or mid-sized firms; and the real estate crowdlending segment which covers mortgage-backed loans via crowdlending platforms.

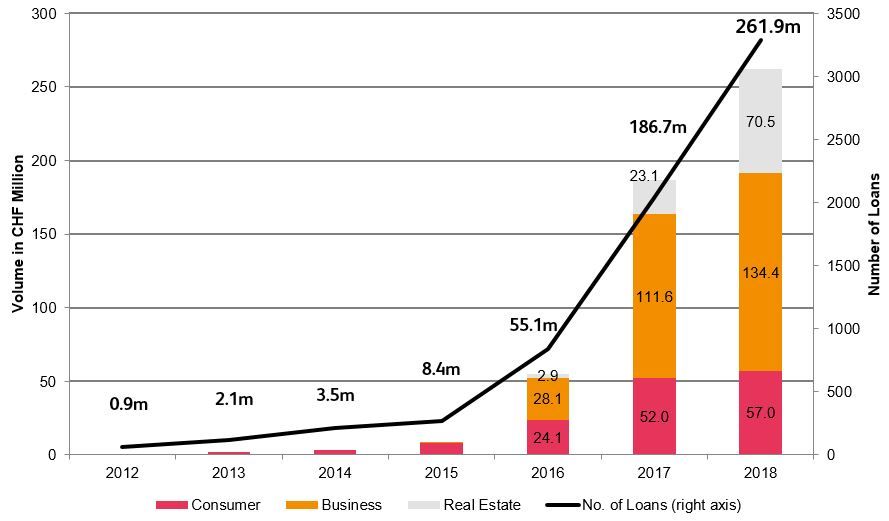

The 2019 Crowdlending report by the University of Luzern together with PwC and the Swiss Marketplace Lending Association shows the performance of the crowdlending market in 2018 based on 13 existing platforms. In total, loans totaling 262 million euros were granted through the platforms, 40% more than in 2017 (CHF 187 million). In 2015, the volume of the brokered loans was still at only CHF 8.4 million, or 3.2 % of this year's amount, as illustrated in the graph below.

Majority of loans go to Swiss SMEs

In particular, the financing of Swiss SMEs (business crowdlending) is making a significant contribution of CHF134.4 million to the share within the crowdlending. In the area of consumer crowdlending, the volume amounted to CHF57 million. Strong growth was also recorded in the area of mortgage-backed loans; the segment brokered CHF70.5 million in 2018 as opposed to CHF23.1 million in 2017. Although growth has been relatively stable in comparison to the previous year, the authors of the study expect continued high growth.

Growing interest from Institutional investors

The interest of professional investors such as asset managers, family offices, funds and wealthy individuals in the asset class continues to grow significantly. Their share of the financed credit volume on the Swiss platforms has once again risen slightly - with substantial differences depending on the platform. Most professional investors focus on larger platforms.

The growing institutionalization has also contributed to the growing significance of off-platform deals. More and more transactions are conducted between borrowers and lenders without a public tender. The market has already evolved in this direction on the international level.

Slow growth in the Swiss crowdlending market

According to the report, the number of crowdlending platforms has declined. Last year, one platform entered the market compared with seven new platforms in 2016 and three new platforms in 2017 (Acredius, Creditfolio and Crowd4Cash). Moreover, the Swiss crowdlending market is also still lagging in comparison with highly developed crowdlending markets such as the UK and the USA, the Swiss market. The volume invested in crowdlending per capita in Switzerland in 2018 was CHF 30 (previous year CHF 22). In the UK, this figure was CHF 89 in 2017 and CHF 119 in the USA.

(Press release/ran)

Please login or sign up to comment.

Commenting guidelines