New report presents good figures from the Swiss biotech sector as high flyers flourish

R&D expenses and the number of employees at privately held biotech companies - mostly start-ups - have reached new record levels. Investments have also recovered. However, the market is divided into successful high flyers and biotechs that are struggling. This gap is even wider for public companies, as the Swiss Biotech Report 2024 shows.

The overall picture of the Swiss biotech industry in the Swiss Biotech Report published today is quite positive. In addition to record revenues of CHF 7.3 billion, the industry raised more than CHF 2 billion – a remarkable 50% increase over 2022. This comprised around CHF 1.4 billion collected by public companies, and the remaining CHF 0.6 billion by private companies. Although R&D investments dipped slightly to CHF 2.4 billion, they are still at very high levels. The latest edition of the Swiss Biotech Report launched today by the Swiss Biotech Association, in conjunction with EY and eight other partner organizations, provides an analysis of the 2023 biotech funding as well as other 2023 key ratios and statistics.

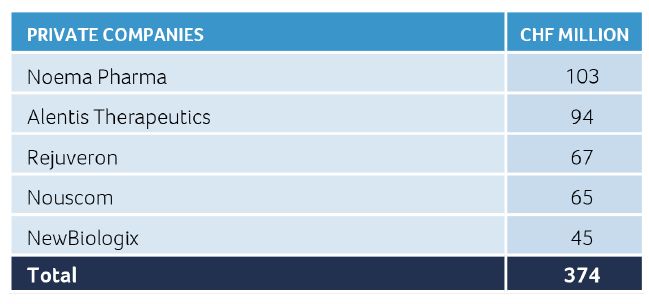

The positive impression is due to the good performance of the industry's high flyers. "There is a clear difference between the haves and have-nots," was the message at the presentation of the report. It is also noticeable that privately held biotech companies - generally start-ups - perform more robustly than listed companies. In 2023, private biotech companies increased the number of employees to almost 8,000 and R&D expenses to CHF 1.15 billion. Growth was driven by increasing investments. According to the methodology of the Biotech Report, which also includes debt financing and strategic investments, private biotech companies received CHF 643 million.

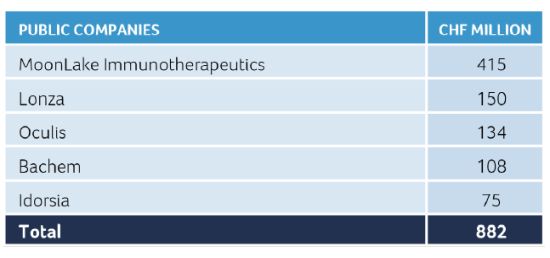

In the area of public companies, investments rose even more sharply - to CHF 1.4 billion - but at the same time the number of employees and R&D expenditure fell. Only the industry's high flyers benefited from the large investments, while others were unable to raise as much money as they had planned and therefore had to reduce their expenditure and headcount.

Top 5 fundings in 2023

On the other hand, the Swiss biotech industry generated record revenues of CHF 7.3 billion compared to CHF 6.8 billion in 2022. This was driven by significant collaboration and licensing deals of public companies, which often successfully partner with large pharma companies, and product sales boosted by a record number of approvals from Swissmedic, EMA, FDA and other global regulatory authorities, including breakthrough advanced therapies from CRISPR Therapeutics, Santhera Pharmaceuticals, Idorsia, Relief Therapeutics and Basilea.

The report contains other indicators that also bode well for the future. For example, the number of biotech companies increased further to 308. In addition, the Swiss biotech sector has an excellently filled pipeline comprising 1200 drugs. More than 400 of these have already been licensed. The most important areas of application are oncology with 462 assets, neurology (180) and metabolic (153).

The international importance of the Swiss biotech sector is also impressively demonstrated by the Swiss Biotech Day, during which the Swiss Biotech Report was launched. The event attracted 2200 participants to Basel, over 1000 of whom travelled from abroad.

(Stefan Kyora)

Please login or sign up to comment.

Commenting guidelines